Key Takeaways

- The U.K. has rejected the Bitcoin Reserve proposal, claiming it’s not a good fit for its market.

- A regulatory collaboration with the U.S. was suggested but a potential BTC reserve was discarded.

- The U.K. has joined Japan, Russia, South Korea, and Switzerland in rejecting the BTC reserve proposal.

Keir Starmer’s Treasury has discarded the proposal to create a Bitcoin Reserve akin to the United States.

The U.K. has joined the growing list of countries that have rejected the use of Bitcoin as a treasury reserve, citing its price volatility over extended periods of time.

U.K. Says No to Bitcoin Reserve

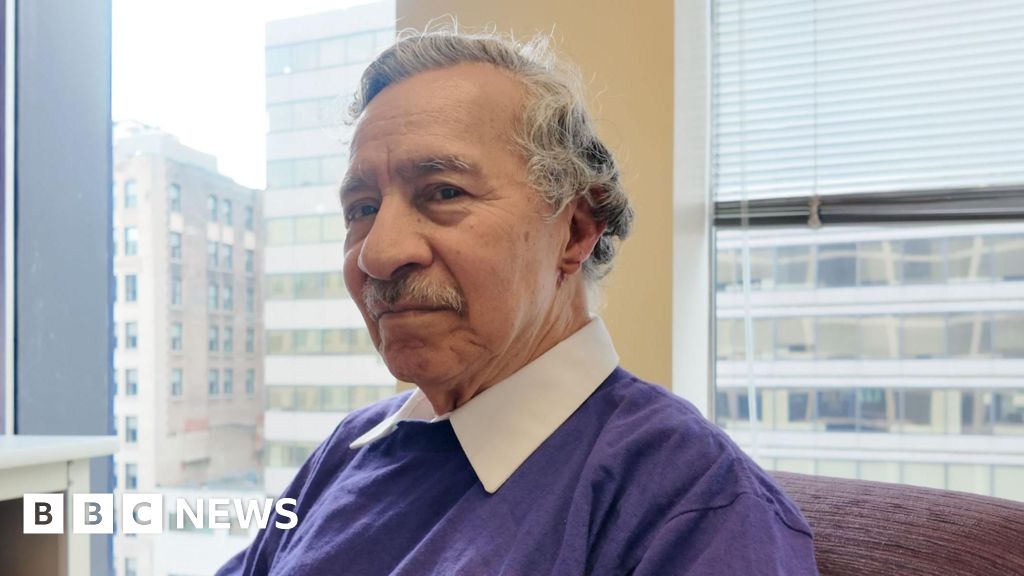

U.K. Economic Secretary Emma Reynolds ruled out a national Bitcoin reserve, claiming it’s not the best fit for their market.

“We don’t think that’s appropriate for our market,” Reynolds said.

“We understand that’s what the U.S. is going for, but that’s not the plan for us,” she added.

You’ll Want To See This

The British MP’s comments came during an interview at the Financial Times Digital Asset Summit in London.

Despite rejecting to follow the U.S lead on its Bitcoin Reserve proposal, Reynolds said the countries will collaborate on the regulatory front for digital assets. She noted that the U.S has undergone significant regulatory changes under the Donald Trump administration.

Reynolds said the country is also very bullish on distributed ledger technology and tokenization and plans to issue “sovereign debt through using distributed ledger technologies,” adding that the procurement process is underway.

U.K. Joins Japan, South Korea and Switzerland

The United Kingdom has joined Japan, South Korea, and Switzerland in rejecting the Bitcoin reserve proposal that would have allowed these nation states to invest public funds in BTC.

In March, Russia also declined a proposal to create a sovereign Bitcoin Reserve, where the government would buy BTC using public funds.

However, following the U.S. shifting to a tax-negative Bitcoin reserve proposal, where the BTC reserve would comprise confiscated BTC, Russia proposed a similar solution.

While major economies worldwide have rejected following the U.S. lead on the Bitcoin Reserve proposal, most are very bullish on positive crypto regulations and greater adoption of the underlying tech in the banking and financial sector.

Was this Article helpful?