Key Takeaways

- Pi’s mainnet is live. Still, exchanges remain cautious due to token maturity and usage concerns.

- A fabricated screenshot, circulated on April Fool’s Day, falsely claimed Binance apologized for delisting Pi as a prank.

- Centralized control risks arise from the core team’s massive token holdings.

- Regulatory ambiguity continues to block listings on major exchanges.

Pi Network is a platform where users mine crypto using their phones. It uses the Stellar Consensus Protocol and a trust-based system called “security circles” that connects users globally to flag bad actors and keep the network secure. The goal is to make mining easy and open to everyone.

Pi enclosed mainnet period began in 2021. Pioneers have waited a few years for its latest major milestone. On Feb. 20, Pi launched its mainnet.

This partially enables external connectivity and allows Pi to be traded on exchanges. However, millions of users are still waiting to unlock their tokens, and optimism about Pi Network’s potential is visible on social media. Dr. Altcoin, for example, predicts a high value for Pi within the next five years.

However, listings on major exchanges remain a struggle for the Pi Network.

This article discusses the main issues holding Pi Network back, why major exchanges have not listed the token, and can it succeed without such listings.

What Are the Key Crypto Exchange Listing Requirements

Major exchanges such as Binance, Coinbase, and Kraken have decided not to list Pi, raising important concerns. Pi Network has encountered several obstacles, and each exchange has highlighted specific issues that influenced their decision.

Before understanding the issues with Pi Network, it is important to understand that exchanges typically follow strict rules before listing any token. A project must meet basic transparency, decentralization, legal compliance, and technical readiness standards.

In general, before a token is listed, it must cover the following elements:

- Working mainnet: The project must run on a live, fully operational blockchain—not a testnet or restricted environment.

- Clear tokenomics: Exchanges look for well-defined supply structures, token distribution plans, and transparent economics that explain how the token functions in the ecosystem.

- Unlocked and transferable tokens: Tokens must be available for users to transfer and trade freely. Locked or restricted tokens often disqualify a project from listing.

- Technical security: A smart contract audit or thorough technical review helps ensure the network is secure and free from vulnerabilities.

- Regulatory compliance: Projects must follow laws in key jurisdictions, including know-your-customer (KYC) and anti-money laundering (AML) rules, and avoid being classified as unregistered securities.

- Community and developer activity: A strong user base and active developer support signal long-term value. Projects with real use cases and ongoing development are taken more seriously.

- Transparency: The team should provide regular updates, public documentation, and clear communication about the project’s progress and goals.

Does Pi Network Meet Major Exchanges’ Token Listing Criteria?

Before listing a token, major exchanges assess whether a project meets specific standards. These typically include factors such as mainnet readiness, token utility, decentralization, legal compliance, and community strength.

Pi Network claims to fulfill many of these requirements. Below is a breakdown of how Pi aligns with the key criteria used by leading exchanges.

Working Mainnet

According to the official announcement, Pi Network transitioned to the Open Network phase of its Mainnet on February 20, 2025.

Clear Tokenomics

Pi Network has indeed published and updated its roadmap and tokenomics. The network has also provided detailed information about the total supply, distribution, and mining mechanisms.

Unlocked and Transferable Tokens

The launch of Pi Network’s Open Mainnet enabled the transfer of Pi tokens, facilitating real-world transactions within its ecosystem.

Pi Network has highlighted that this development powered the Pi Fest commerce event, where users could utilize Pi for goods and services, indicating a step towards practical adoption.

Security

Pi Network has also emphasized its commitment to security. In preparation for the Open Network phase, the team introduced new protections such as two-factor authentication (2FA) to prevent fraud during token migration.

Regulatory Compliance

Pi Network states that it uses a “proprietary KYC solution to scalably verify the identity of millions of Pioneers all over the world to onboard them to the Mainnet blockchain and ecosystem.”

Community and Developer Engagement

Pi Network has a large and active community of “Pioneers,” with reports indicating millions of users worldwide. This strong user base reflects high levels of community engagement.

The project has continued developing its ecosystem through tools like the Pi Browser and Pi Wallet, signaling ongoing developer activity.

Transparency

The project maintains official communication channels to provide updates and ensure transparency.

Why Pi Network Isn’t Listed on Top Crypto Exchanges

Despite Pi Network’s efforts to cover all the major elements theoretically supporting a listing on top exchanges, concerns around transparency, regulatory compliance, and liquidity remain.

Each major exchange has its own standards and review process. Here’s how the situation looks across Binance, Kraken, and Coinbase.

Binance: Backed by Users, Blocked by Standards

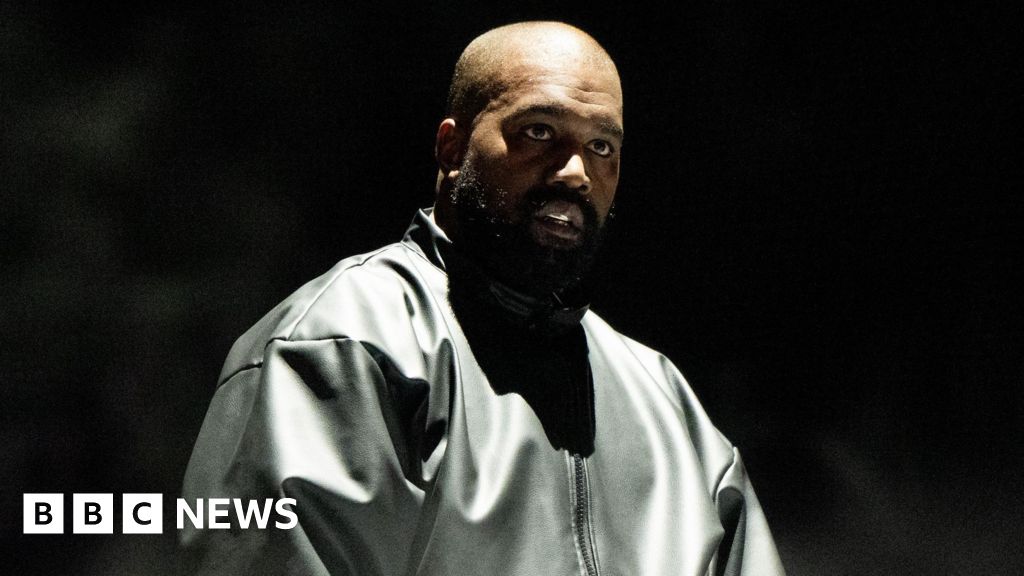

Binance has a community voting mechanism that allows members to vote for new tokens to be considered for listing. Pi’s community support was clear, reaching 86%. However, Binance decided not to list it.

A prank circulating around April Fools’ Day added confusion—a fabricated screenshot shared by Pi Network claimed Binance had apologized for delisting Pi, using hashtags like #AprilFool and #Prank, among others. But Pi was never listed to begin with, and Binance did not respond officially.

Binance’s internal team considers multiple listing criteria, including:

- Tokenomics transparency: This remains an issue, as the core team has yet to share full details about token distribution, locking, or burning mechanisms.

- Project maturity: Despite its large community, Pi Network still faces challenges tied to the project’s maturity, especially after its recent mainnet launch.

- Utility: This highlights the need for Pi to demonstrate practical use cases beyond its mobile mining app.

- Regulatory compliance: Pi Network’s regulatory status is still challenging as it navigates the global landscape of ambiguous and varied regulations.

Without this information, Binance likely sees a risk of centralization or potential manipulation — which goes against its standards for user protection and long-term stability.

Coinbase: Regulatory Clarity for Pi

Coinbase’s Asset Hub sets clear requirements like legal compliance, security, and market traction.

Pi Network’s lack of transparency in its tokenomics and early-stage development likely fall short of these standards.

The exchange also gives priority to tokens with a clear regulatory status — especially in the U.S., where Coinbase is based. Pi’s unclear legal standing remains a major barrier to listing.

Still, Coinbase Chief Legal Officer Paul Grewal recently posted on X how Coinbase takes “Pi Day at @coinbase very seriously.”

His comment has sparked high hopes for Pi’s future.

Kraken’s Position on Pi Network Listing

While user speculation on platforms like X and Reddit about the potential Pi listing on Kraken has been widespread, these discussions remain speculative.

Concerns persist regarding Pi’s liquidity and the centralized control of its token supply.

Data shows six wallets linked to the Pi Network team hold over 60 billion Pi, while another 20 billion are spread across thousands of connected wallets.

This situation damaged the credibility of Pi’s core team and added to the list of unresolved issues.

What Factors Influence Pi Network’s Success Without Major Exchange Listings

Several key factors influence Pi Network’s ability to succeed without major exchange listings:

- Community support and internal ecosystem: A significant portion of the Pi Network community has preferred focusing on internal development over external exchange listings . In a poll conducted by Newsway, approximately 61% of Pi Network pioneers supported delisting Pi Coin from exchanges, aligning with the core team’s strategy to prepare for the open mainnet upgrade.

- Challenges in securing exchange listings: Pi Network has encountered obstacles in obtaining listings on major exchanges. For instance, Binance opted to conduct a community vote before considering the token’s listing, reflecting a cautious approach.

- Development of dApps: The core team aimed to have at least 100 dApps ready before the open mainnet launch to ensure a robust ecosystem. As of February 2025, approximately 80 to 85 DApps have been developed, indicating progress toward this goal.

While major exchange listings can enhance a cryptocurrency’s visibility and liquidity, Pi Network’s emphasis on community consensus, internal ecosystem development, and regulatory compliance suggests a strategy that does not solely rely on such listings.

By building a strong, self-sustaining network with active user engagement and a diverse range of DApps, Pi Network aims to establish a solid foundation that could support its success, irrespective of major exchange listings.

The Future of Pi

It is important to note that some exchanges—such as OKX and Bitget—listed Pi after the launch of its mainnet, while others remain cautious, like Kraken, Coinbase, and Binance.

For example, Ben Zhou, co-founder and CEO of Bybit, has publicly stated he believes Pi is a scam. He posted, adding that “Bybit will not list a scam.”

As if that weren’t enough, the value of Pi has dropped by 77% since the launch of its mainnet. Its recovery could depend on being listed on major exchanges.

Conclusion

Pi Network has made progress by launching its open mainnet and growing a global user base. However, major exchanges still raise red flags regarding transparency, regulatory standing, and token control.

Until the core team addresses these concerns with full clarity and utility, a listing on Binance, Coinbase, or Kraken will likely remain out of reach.

FAQs

What are the main concerns about Pi Network’s tokenomics?

The main concerns revolve around the lack of clear details about token distribution, locking mechanisms, and the significant amount of Pi held by the core team, raising questions about potential centralization.

Has Pi Network’s mainnet launch addressed these concerns?

While the mainnet launch is a significant step, exchanges are still waiting for more evidence of practical use cases, full token transferability, and a clear regulatory status before considering listing Pi

Is there any hope that Pi Network will be listed in the future?

There is potential, especially with the mainnet open network phase. It may be listed if Pi Network can address the transparency and regulatory issues and prove real-world utility.

Was this Article helpful?