Real-world asset (RWA) crypto tokenization is quickly gaining traction, emerging as one of the most resilient sectors during the crypto market downturn.

Major financial institutions, led by BlackRock and its BUIDL fund, are interested in the space.

Hashkey Capital, a digital asset and blockchain technologies investment firm, is highly bullish on the future of this sector.

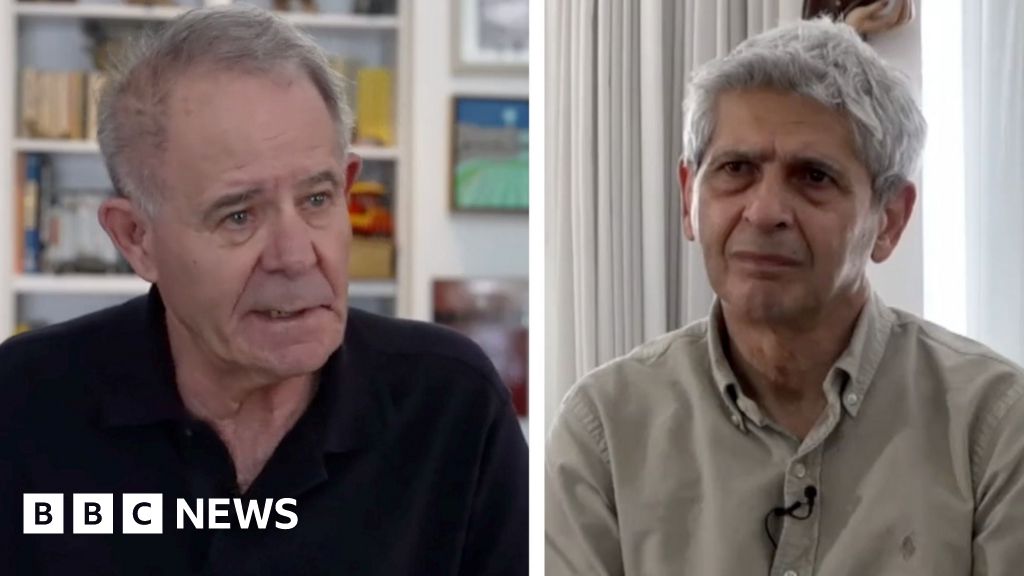

In this article, we will analyze the RWA growth for the past year and discuss it with Li Liang, the CEO of HashKey OTC, who will offer some insights into what lies ahead in 2025.

RWA Performance in Crypto

RWA has been the best-performing crypto sector in the past year, with an average growth of 237%. Most categories have a negative return, with only Bitcoin, privacy coins, and exchange tokens being slightly profitable.

The most significant RWA crypto projects are Mantra, which reached its all-time high on Feb. 23, and ONDO.

PENDLE, the previous mainstay in the top 100, fell behind in 2025 and currently ranks as the #131st biggest cryptocurrency.

Well-known cryptocurrency analyst rektdiomedes is highly bullish on the future of RWAs, especially Maple Finance.

He believes the crypto industry will develop a massive securitization and capital market infrastructure.

Want to add MANTRA OM to your portfolio? Discover the leading platforms for buying and selling MANTRA OM on our exchange review page.

If that happens, Maple Finance could be one of the beneficiaries since it focuses on institutional credit and on-chain capital markets.

The DeFi Investor tweeted that the total value of RWA has doubled in the past 12 months alone. Its total value is over $18 billion, the majority of which is from Private Credit.

Furthermore, the number of holders and unique RWA interactions over time are both at all-time highs and increasing.

Other positive news is that BlackRock’s tokenized treasury fund BUIDL has reached a $1 billion asset value , becoming the largest tokenized RWA.

Hashnote, the issuer of a tokenized money market fund that Circle acquired in January, is second with nearly $900 million and has shown the largest one-year change.

Hashkey Capital Discusses RWA

HashKey Capital also shares a very positive view of the future of RWAs in 2025.

Li Lang, the HashKey OTC CEO, singled out the tokenization of sustainable assets, such as renewable energy projects or carbon credits, as one of the most exciting areas to consider in 2025.

Another interesting development is the integration of RWAs with Layer-1 and Layer-2 blockchain solutions. This could improve scalability and reduce transaction costs, which are key hurdles for broader adoption.

When discussing MANTRA’s remarkable growth, Liang praised its user-centric approach, crediting it for driving the price’s performance.

However, Liang believes that a potential bear market could pose challenges, though RWAs can weather these challenges better than other speculative assets.

A bear market typically brings reduced liquidity, heightened risk aversion, and pressure on valuations, which could slow the pace of capital inflows into tokenized RWAs. However, RWAs possess unique characteristics—such as their grounding in tangible value and potential for stable cash flows—that may offer a degree of insulation compared to more speculative crypto assets.

When asked whether RWAs could overtake Decentralized Finance (DeFi) in Total Value Locked (TVL), Liang suggested that DeFi’s reliance on volatile crypto-native assets can become a liability in a bear market.

Liang noted that institutional adoption and regulatory clarity will determine if RWAs overtake DeFi.

Promising Sector

The RWA sector experienced some of the biggest growth last year in price movement and institutional interest. Despite the ongoing bear market, some tokens, such as MANTRA, reached all-time highs in March.

The remainder of 2025 is promising, with developments such as tokenizing sustainable assets playing a key role in the sector’s growth.

Disclaimer:

The information provided in this article is for informational purposes only. It is not intended to be, nor should it be construed as, financial advice. We do not make any warranties regarding the completeness, reliability, or accuracy of this information. All investments involve risk, and past performance does not guarantee future results. We recommend consulting a financial advisor before making any investment decisions.

Was this Article helpful?