In the scrum to keep the wheels of trade turning, Chinese companies are pivoting to neighboring countries to escape President Trump’s crippling tariffs.

The hustle is on show in Vietnam. Factories that make everything from jeans to Christmas wreaths are trying to get there fast. The ones that have already moved are ramping up. The Chinese e-commerce platforms Alibaba and Shein are helping companies find manufacturing alternatives in Vietnam.

The race to get out of China has gathered so much pace in recent weeks that a social media genre of fixers has surfaced to offer tips on how to reroute goods through not only Vietnam, but places like Thailand and Malaysia too.

The cost of sending products to the United States has soared in recent weeks, forcing factories to find new trade routes. Last month, China’s exports to Southeast Asia surged as shipments to America plunged, Chinese government data released on Friday showed.

While Mr. Trump has imposed 145 percent tariffs on China, he has paused new tariffs on Vietnam and other Asian countries until early July. Factories across the region have gone into overdrive.

“It feels like everybody is rushing to find a Vietnamese partner,” said Vu Manh Hung, who owns seven factories in northern Vietnam and was inundated with requests from Chinese businesses.

They were hoping that his factories could take on orders that were now impossible to fulfill in China with such high tariffs. He did not seal any deals. But that was partly because his manufacturing lines were already busy, under pressure from American clients to deliver orders before July.

This sense of panic in the Chinese supply chain is familiar.

In 2018, during his first term, Mr. Trump’s tariffs on China caused many multinational companies to search for alternative locations to manufacture their goods. Those tariffs were not steep enough to kick off an exodus. Now, Mr. Trump’s tariffs are so high they have all but stopped trade between the two countries, even pushing Chinese businesses out of China.

For many Chinese companies, Vietnam is both a long-term solution and short-term fix. The countries share a border, and Vietnam has a large population of young people willing to do grinding factory work.

But there are challenges for Vietnam.

Along with the dozens of other countries whose tariffs are on hold, Vietnam is trying to work through a trade deal with American officials who want to limit China’s use of Vietnam as an alternative way into the United States for exports.

During the first U.S.-Chinese tariff war, Chinese companies built factories in Vietnam. Many of those factories are now ramping up orders. One of them is QIS Sport Goods, which opened operations in Vietnam in 2019.

“We are stronger now, and we can offer competitive prices to customers,” said Nguyen Jan, who is Vietnamese and joined the company three years ago. “Everything has been busier.”

QIS Sport Goods makes water sporting products like kickboards, surfboards and stand-up paddle boards at two factories, one in the southern Chinese city of Dongguan and another in northern Vietnam.

The company employs around 150 people in China and 400 in Vietnam, where it is hustling to hire more.

Another Chinese company, Dongguan Box, recently completed a production line in its Vietnamese factory just for its American customers like Tiffany & Company and Hallmark.

Rita Peng, the marketing manager, said the calls from her American customers started coming in April, when Mr. Trump began to escalate tariffs on Chinese goods. They asked: Could she quickly shift their production to Vietnam?

She was happy to oblige, but Ms. Peng said the change made little sense to her. Picking up an elaborate red gift box with a paper flower and a two-sided opening, she explained why.

“If I make this in China, this box is very easy to make,” she said. “Very easy. But if I make this whole box in Vietnam, the cost will be very high.”

A box that costs $1 to make in China costs $1.20 in Vietnam, she said, mostly because she needs to ship the raw materials. She said her clients still wanted her to use her Chinese factories to fill orders going to Europe.

Dongguan Box used to have 1,000 workers in China, but that number has been cut down to 200. In Vietnam, there are now 600 workers. But Ms. Peng said she was optimistic and thought that the situation was only temporary.

“I believe the U.S. will solve these problems soon,” she said.

E-commerce platforms are doing their part to help Chinese factories find substitutes.

The fast fashion platform Shein is offering incentives to Chinese factories to help with the cost of moving to Vietnam, according to one factory owner. And the e-commerce giant Alibaba, which helps merchants find business partners, has dispatched employees in Vietnam to help businesses find alternatives to China before the pause on tariffs in Vietnam ends, a Vietnamese account manager at Alibaba said.

Shein did not respond to a request for comment.

On Chinese social media, a flurry of agents have cropped up offering tips on how to skirt trade rules. For instance, one recent post on Xiaohongshu, the Chinese app also known as RedNote, outlined how to hide a product’s made-in-China origin by shipping it to Malaysia or another nearby country and repackaging it before sending it to the United States.

“Folks, the high tariffs imposed by the United States on China have reached an astonishing level,” the post said. “But it can’t stump us smart folks.”

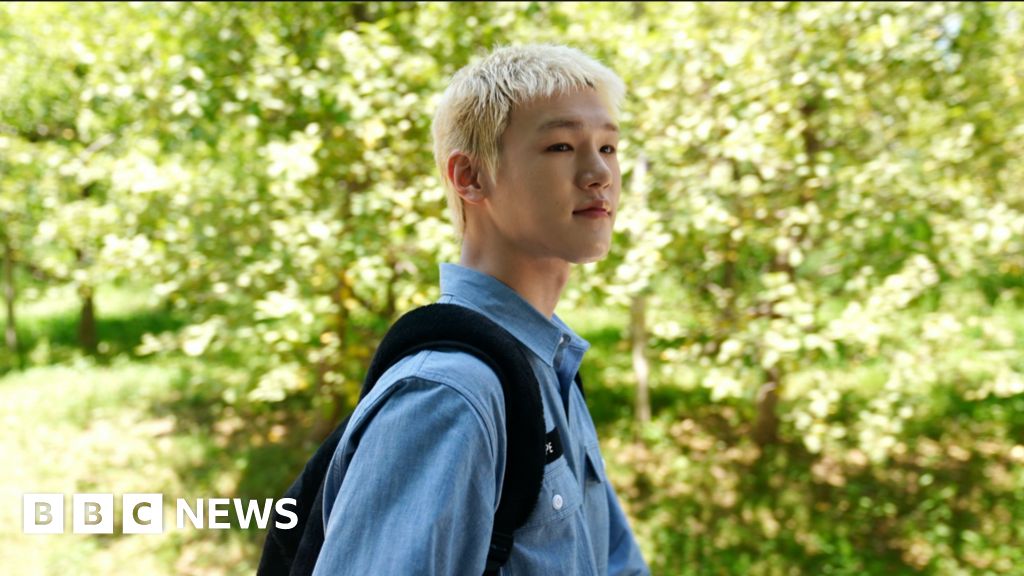

The interest in Vietnam was evident recently in the southern Chinese city of Guangzhou. Nie Shiwen, who owns a garment factory, said some of his peers had started to expand in Vietnam. For now, he has decided against doing this because of the logistics of getting fabric and other materials to Vietnam, which can take weeks.

“Nowhere is as fast as China,” Mr. Nie said.

But Jia Yue Technology, a Chinese company that makes Christmas ribbons, stockings, wreaths and gift bags, has already made the leap to Vietnam. Over the past three years it has shifted more than half its production from China, said Jack Xu, who was acting as a translator for a company representative at a trade fair in Ho Chi Minh City. And now it is mulling whether to do more in Vietnam because most of Jia Yue’s customers are in the United States.

“You know Christmas items,” Mr. Xu said, pointing to a wall of green, plastic wreaths. “Americans, they need it!”

Mr. Xu said he was confident that Jia Yue Technology would be able to weather the trade war since it had a foot in both countries. But he said he hoped that China and the United States could come to a deal.

“For most Chinese, we still want to sell things to Americans,” Mr. Xu said.

Reporting was contributed by Tung Ngo from Ho Chi Minh City, Zixu Wang from Hong Kong, and Meaghan Tobin and Siyi Zhao from Guangzhou, China.

Source link